Elevating Healthcare Operations with Microsoft Power Platform

Business Problem/ Scope of Work

The Client is a privately-owned financial institution that has been a leading voice and solutions provider for over two centuries. Our Private Banking, Investment Management, and Investor Services cater to the most discerning individuals and institutions. Our workforce operates across multiple locations throughout North America, Europe, and Asia.

Largest private investment bank and its associates are devoted to adhering to all anti-money laundering (AML) regulations in the locations where its operations are conducted.

Being aware of the customers' and their business requirements is part of the Know Your Customer (KYC), Customer Identification, Due Diligence and Extended Due Diligence procedure to provide the customers with various product types. The KYCView application helps to identify, assess the customer entity type, and implement a suspicious activity program.

Business Solution

Compliance Systems' KYCView 2.0 is an upgraded version of its existing KYCView application. It is composed of configurable components that enable the adherence to all anti-money laundering regulations and laws in investment banking operations.

It obtains customer identification data along with details about the legal entity and ownership, as well as investment particulars of different entity types.It also has a defined workflow for different verification processes and offers regulatory reports for various jurisdictions.

Furthermore, KYCView's verifiable data is applied for customer verification and due diligence for different investment goods.

Technical Solution

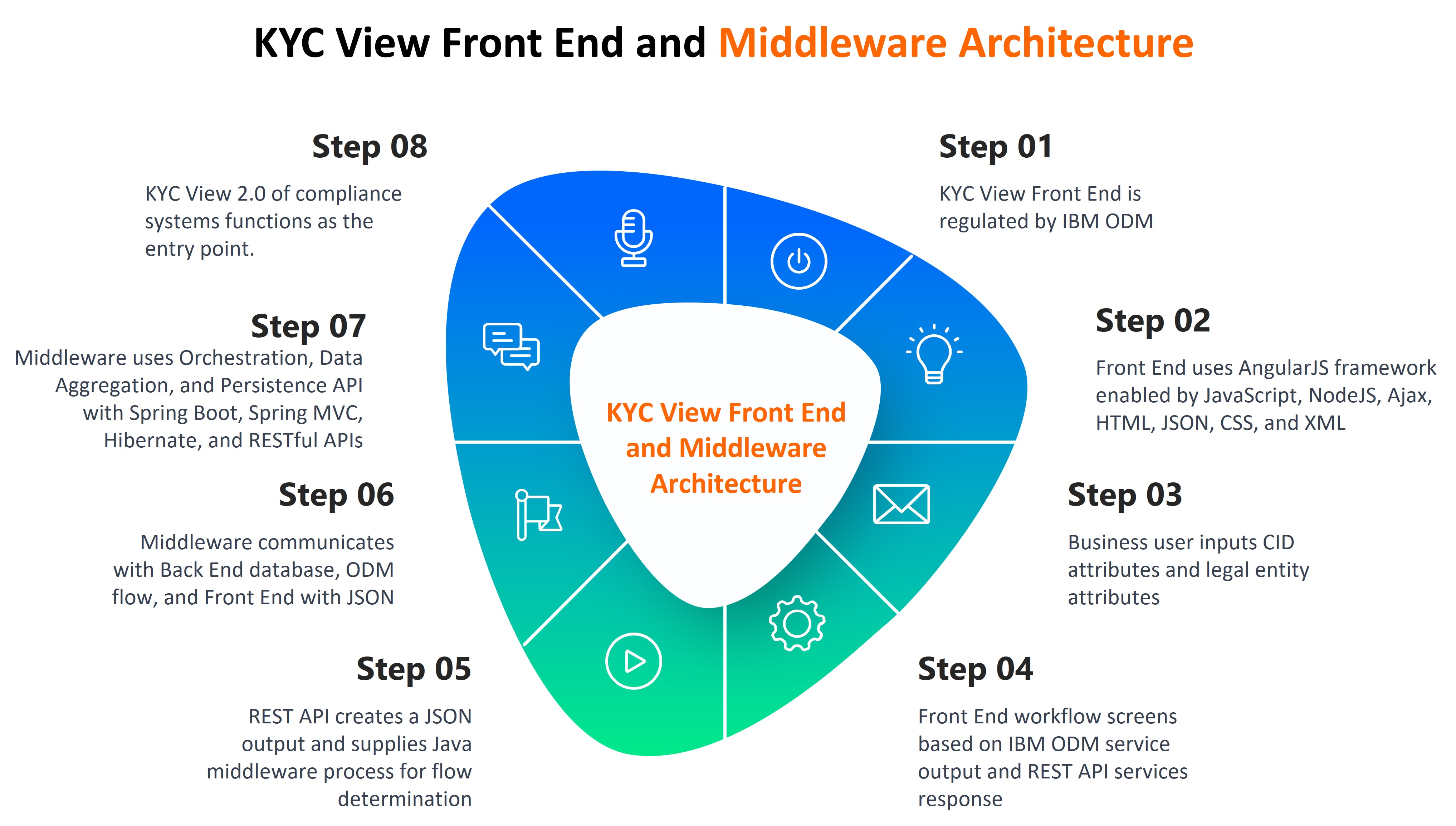

The KYC View Front End operation is regulated by IBM ODM and is responsible for deciding the next attribute screens based on customer identification attributes and primary profile information. The front end construction is made with the AngularJS framework which is enabled by JavaScript, NodeJS, Ajax, HTML, JSON, CSS, and XML to provide a platform for business user input of CID (Customer Identification Document) attributes and legal entity attributes.

The front end workflow screens are based on the service output from IBM ODM business rule execution and through REST api services response which creates a json output and supplies a java (Spring Boot) middleware process for flow determination.

The middleware deals with the core logic of communication with the back end database, ODM flow and the front end (with json) via Orchestration, Data Aggregation and Persistence api with a service method based configurable framework using SpringBoot, SpringMVC, Hibernate and RESTful apis. The KYCView 2.0 of compliance systems also functions as the entry point.

Technologies/ Skills Used

Java, J2EE, JDBC, Hibernate, Spring, Spring MVC, Spring-Boot, Spring-JPA, HTML/HTML5, AngularJS, JavaScript, CSS, AJAX, JSON, Bootstrap, NodeJS, Servlet, JSP, Jenkins, XML, XSD, SOAP, WSDL, REST, Jersey, JAX-RS, Web Services, Gulp, BMP ODM/Rule Engine, Apache PDF api’s, GIT, JIRA, Maven, Oracle, SQL Developer, JUnit, Mockito, Log4J, Sprint Tool Suite IDE, Intellij IDE,Gulp, WebSphere Application server, Windows and UNIX with SDLC, Agile/SCRUM methodologies.

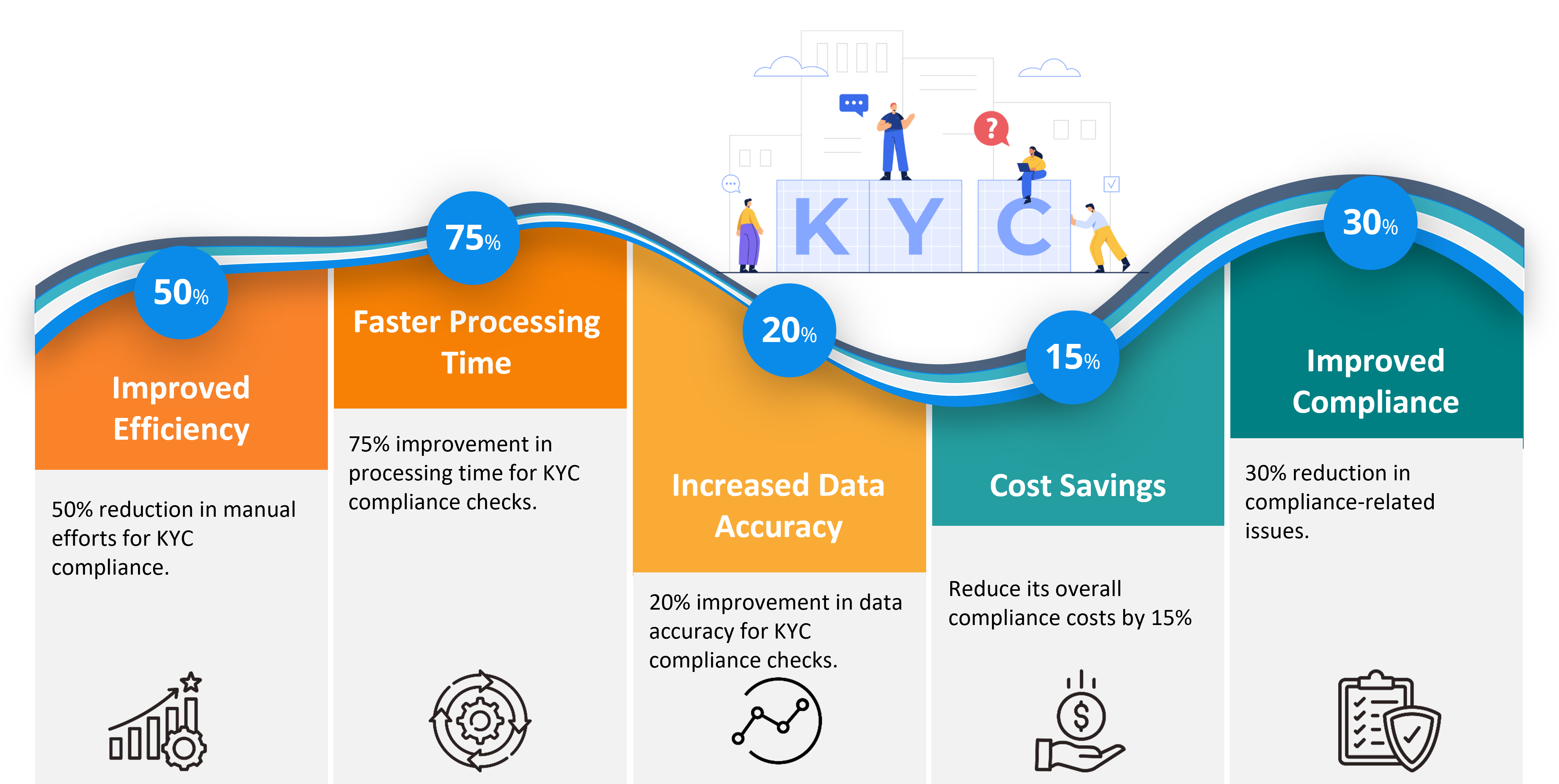

Customer Success Outcomes

Latest Case Studies

Our Case Studies

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.png)

.png)

.jpg)

.jpg)

.png)

.png)

.png)

.png)

.png)

.png)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)